Poultry Farm Appeal

Already raised £338 of the £1100 required to make this project happen..

Appeal – Nandi School Project: Support Our Poultry Farm Initiative!

We are excited to introduce an innovative addition to the Nandi School Project – a poultry farm! In collaboration with the project management team, we have devised a plan to establish this farm as a part of our school program, educating children about poultry rearing and welfare. Not only will it provide valuable knowledge, but it will also generate income, ensuring sustainability for the school.

We firmly believe that incorporating commercial elements into our program will make the school self-supporting, enabling us to continue our mission effectively. Our poultry farm will serve this purpose perfectly, teaching children the principles of poultry rearing and offering the end products of young hens and eggs for sale. This financial aspect will significantly contribute to the success of the project.

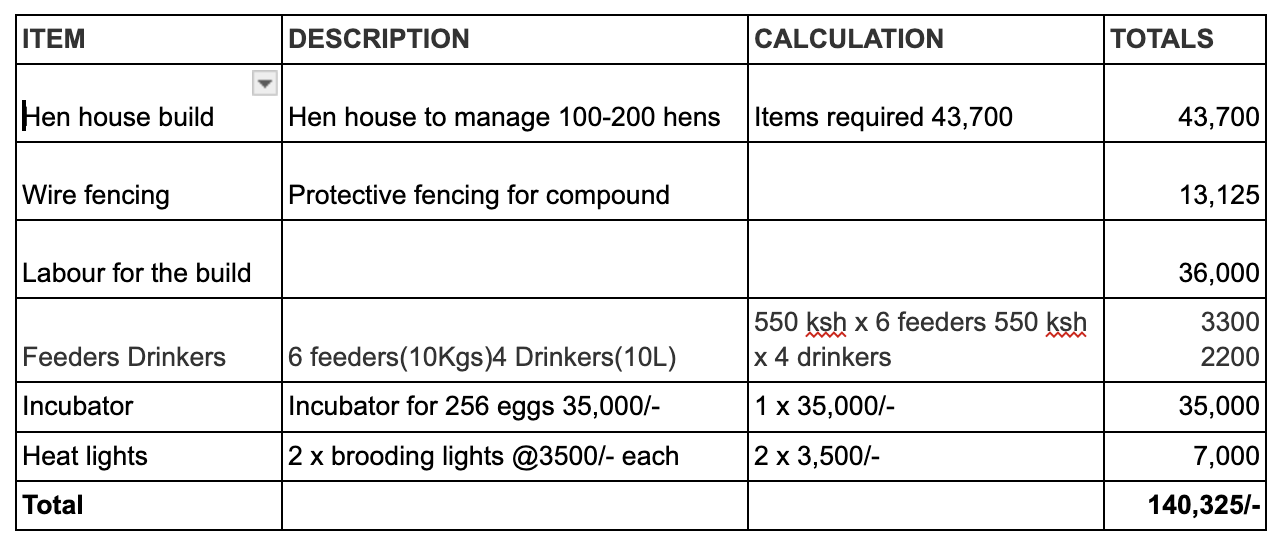

Start-up capital required for infrastructure and equipment.

This is an updated report (6/2/2024) regarding the costs of setting up a poultry farm at the Nandi School Project. The project will start with the building of a compound with a shed to house the birds. It is anticipated that the farm manager will deal with all aspects of the chicken rearing and general management, with the children getting valuable lessons in animal husbandry.

Depending on fluctuating exchange rates the GBP cost is £1075 (Currently 180/- to £ 6/2/24)

Total fixed assets required for 100 birds = 140,325/-

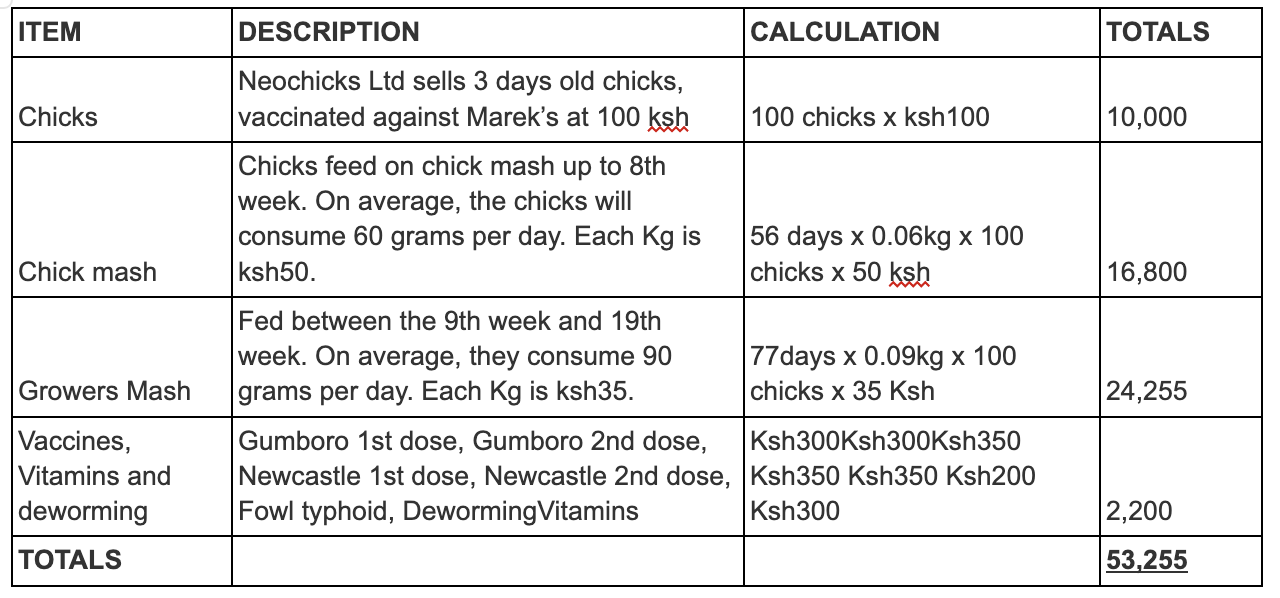

Stock requirement

This stock will be reared to produce the necessary layers, broilers and breeding hens and cockerels.

Below is a table detailing the feed, vaccines and supplements required to successfully breed the hens up until the 19th week.

The calculation is based on 100 chicks being reared which adds up to a lifetime cost of 532/- per bird.

B) Total stock required for 100 bird starting package = 53,255/-

Funds required to start 100 bird project,

Equipment A + Stock B Total = 193,580/-

We are seeking your generous support to ensure the success of the poultry farm initiative. It has the potential to generate a revenue of £10,000 per year, showcasing the enormous impact your contributions can make.

Instead of purchasing material gifts for someone who seemingly has everything, why not gift them a chicken to celebrate their special day? Not only will they have a unique present, but the chicken will also be named after them and provided with utmost care. It’s just one of the creative ideas we have to support the establishment of the poultry farm at our school next year.

By contributing to this project, you will not only empower the children with education and practical skills but also help us build a sustainable future for the Nandi School Project. Your generosity will make a tangible difference in the lives of these students.

Please give generously to make this initiative a reality. Together, we can create lasting impact and transform the educational experience for these children.

Thank you for your support and consideration.

Warm regards,

The Nandi School Project Team